“Trade what’s happening, not what you think is gonna happen.” – Doug Gregory

Price action trading is the process of reacting to current price to make entry, exit, and holding decisions. It is replacing opinions and predictions with valid signals. A signal is a quantified reason to enter a trade, stay in a trade, and exit a trade. A signal should either be based on back tests of historically price data showing an edge in the past or price action trading can be used to create good risk/reward ratios by setting stop losses and profit target on entries. Both ways can be valid while backtested strategies tend to be more mechanical and using risk/reward ratios tend to be more discretionary.

- An entry signal can be based on price alone or a technical indicator. An entry signal should give you a better chance of profits than randomness. Where you get in should have an edge whether you are buying a break out or a dip in price there should be a good reason for the entry.

- A stop loss should be placed at a price level that tells you that the trade is not going to work out. A stop loss is to keep your losses small so you have a better chance to be profitable. A stop loss helps you figure out the risk in your risk/reward ratio. The biggest thing that causes unprofitable trading are big losses, stop losses remove big losses from your sequence of trades.

- A trailing stop can be used to tell you when it may be time to take profits because a winning trade may be reversing against you. It is also useful to maximize gains. When a trade moves in your direction you turn your initial stop loss into a trailing stop by rising the price level you will exit at to a higher price to both avoid giving back too many open profits and to have an exit strategy for when the trend bends.

- A profit target can be the technical level that your trade begins to have a bad risk/reward ratio due to the extension of price into overbought territory or an extension from a normal trading range. A profit target for price helps you determine if the risk is worth the potential reward.

Trading price action requires a quantified system that you create when the market is closed to use when the market is open. Your system has to be something you believe is a profitable process based on your data. It must meet your own risk tolerance levels and potential goals for returns.

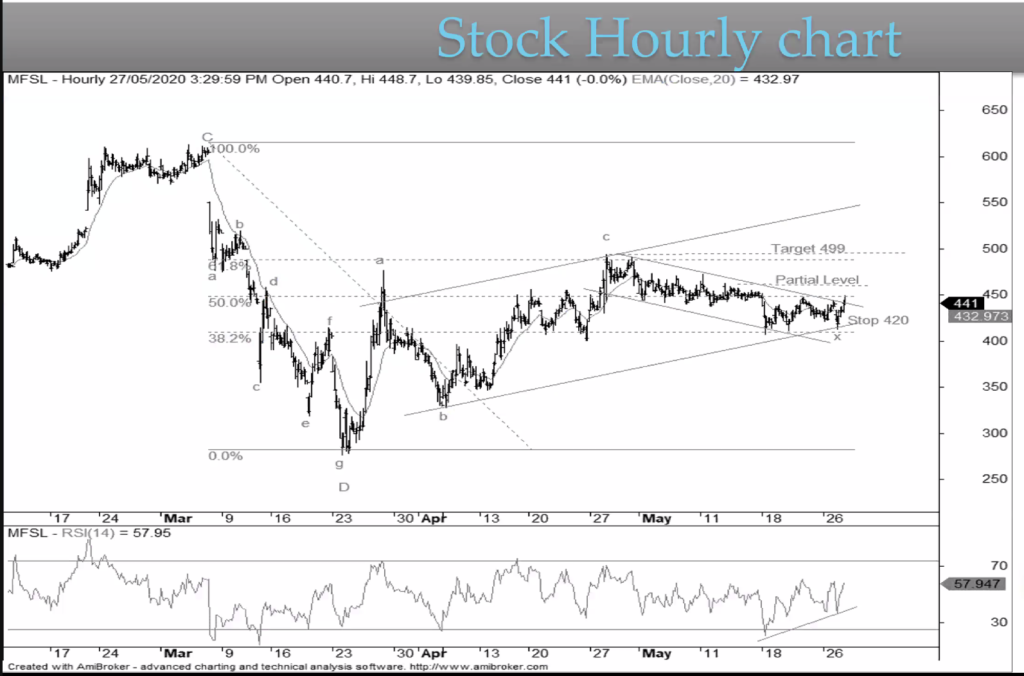

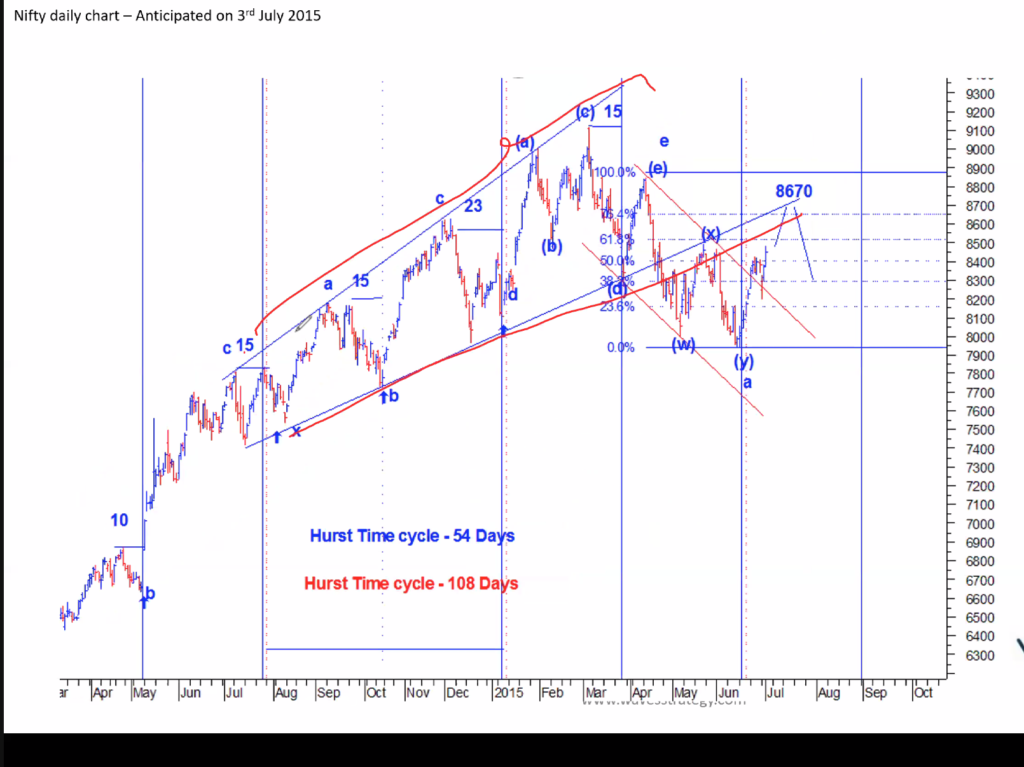

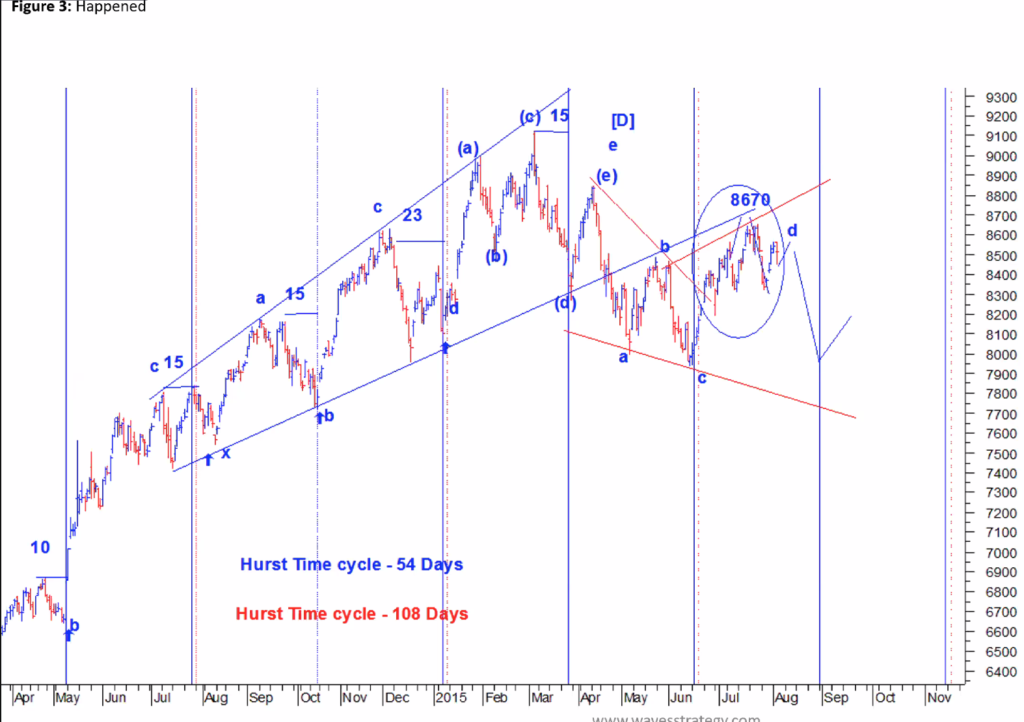

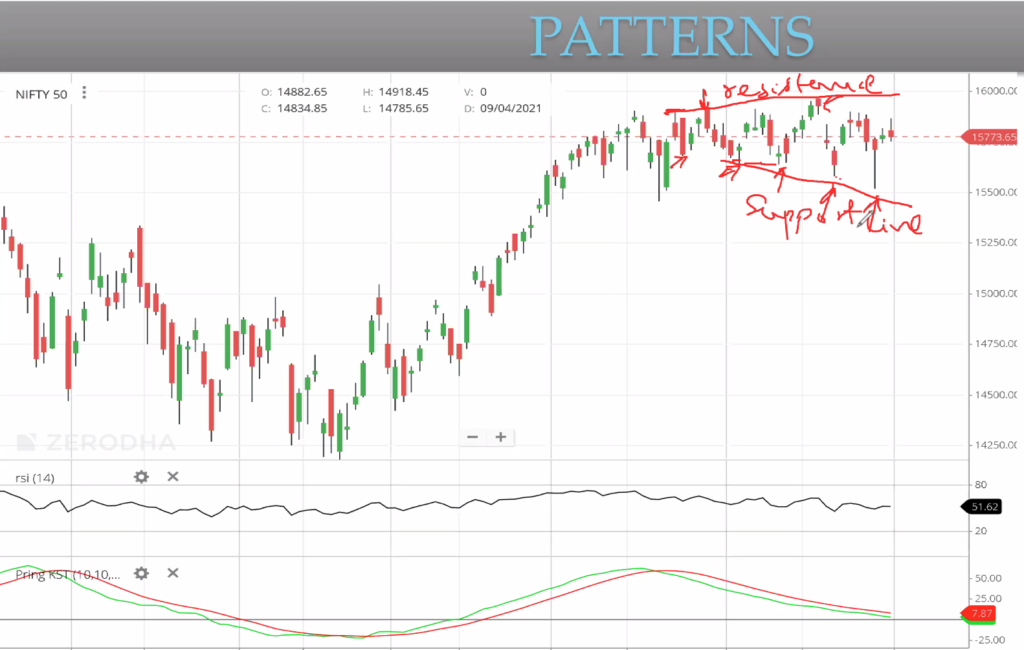

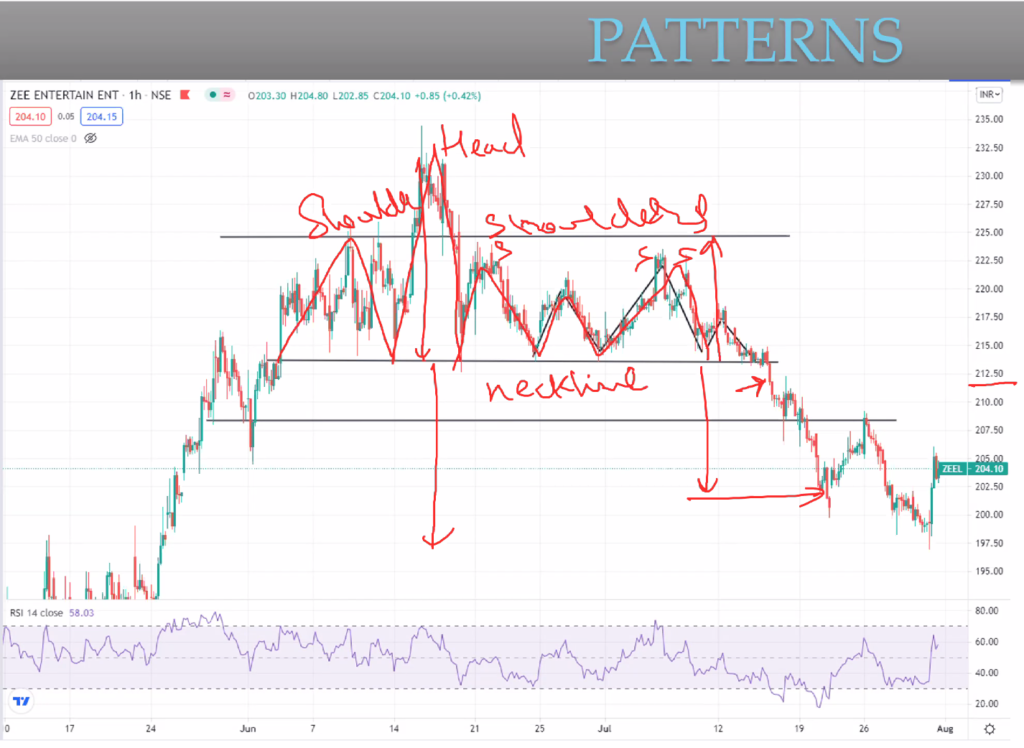

Look out to check if the pattern is repeated

Market produce pattern with some changes, not necessarily same as text-book

What is this pattern below? Consolidation?

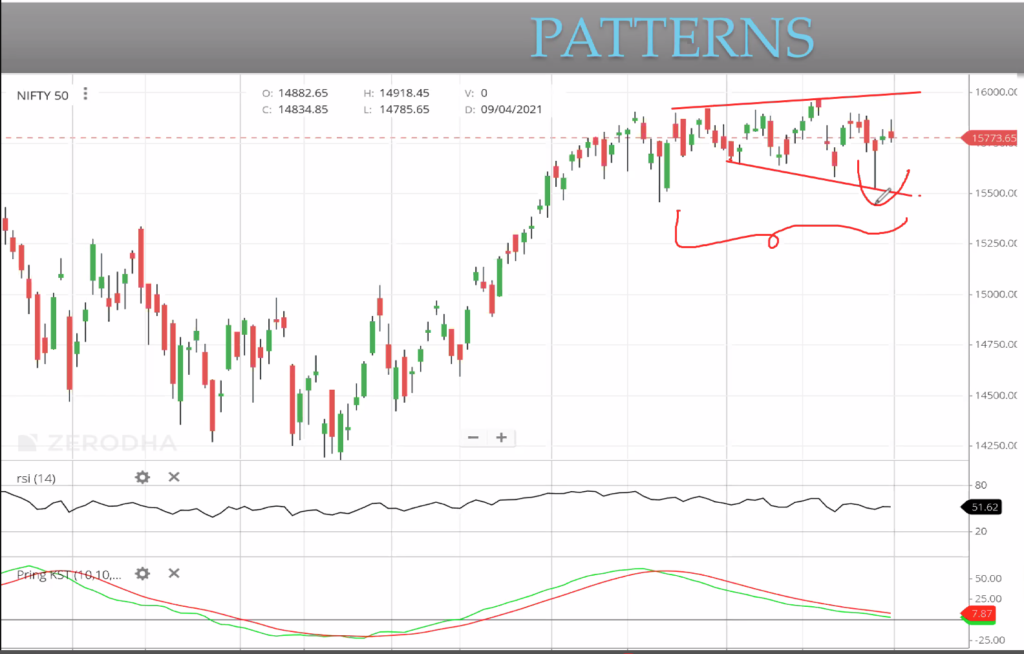

Now this appears to be an expanding triangle

Traders will get trapped here , in this triangle pattern

Patterns formed from area of significance

Traingle Pattern shifted upside

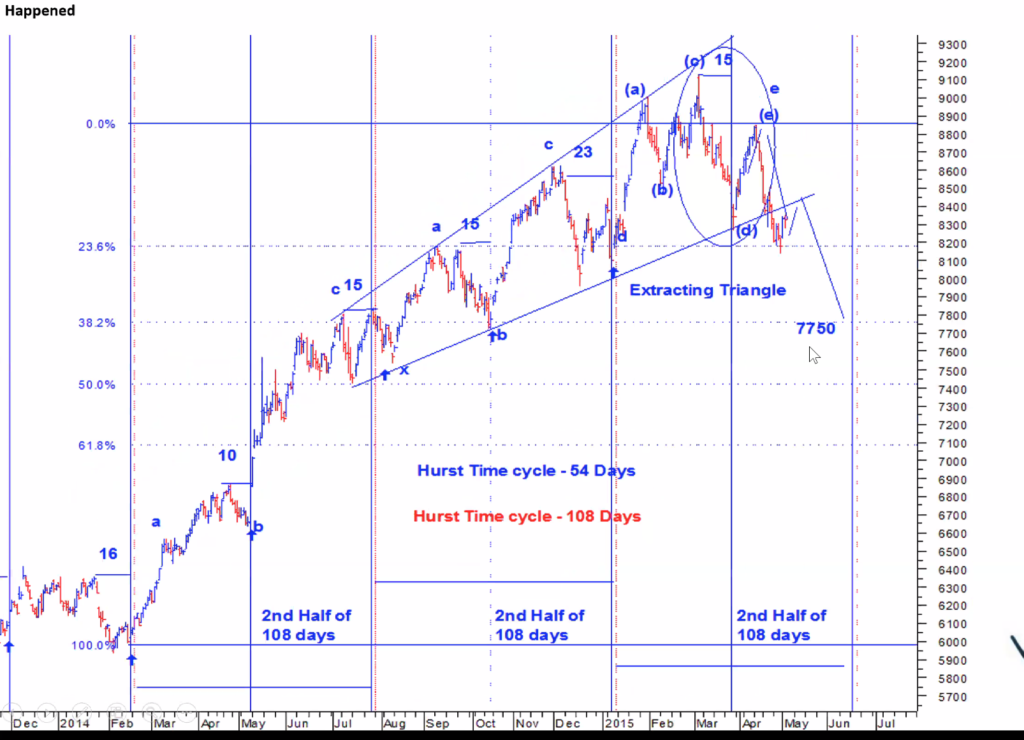

Descending Triangle

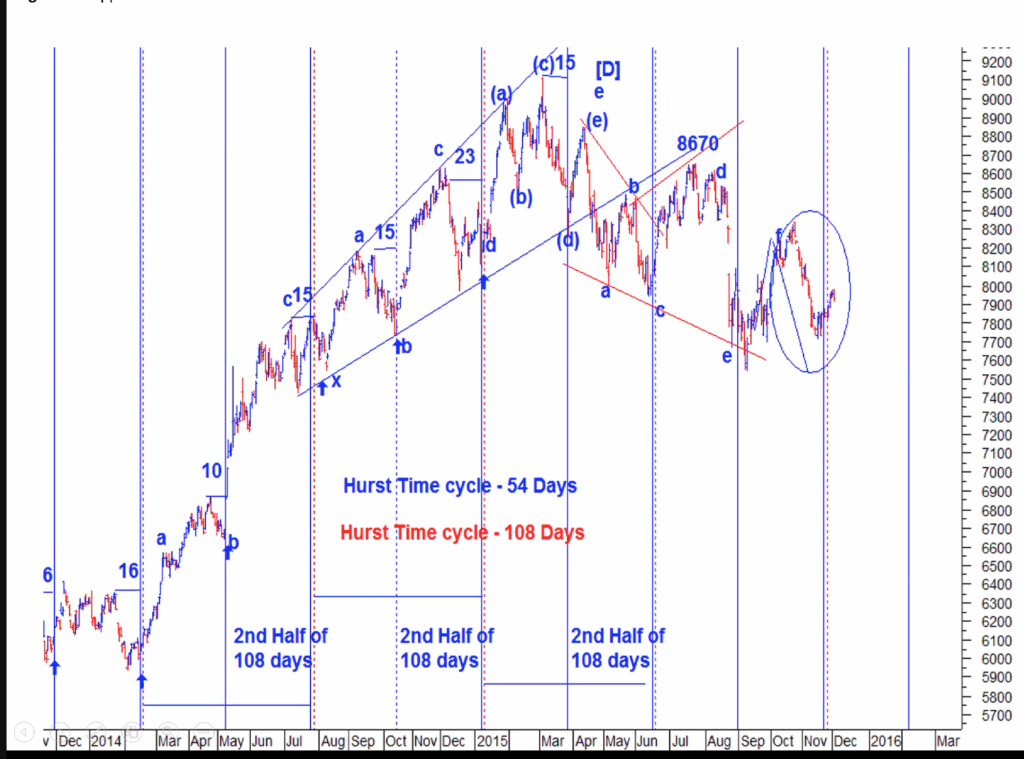

Market is Fractal, small waves make big wave … 15 minutes shows triangle

When bigger wave is in sync with smaller wave then take position

Big Players accumulate, see the accumulating zones

See the magnet price, which has a max volume profile, meaning max number of trades happening at that price

Combine wave theory with Pattern