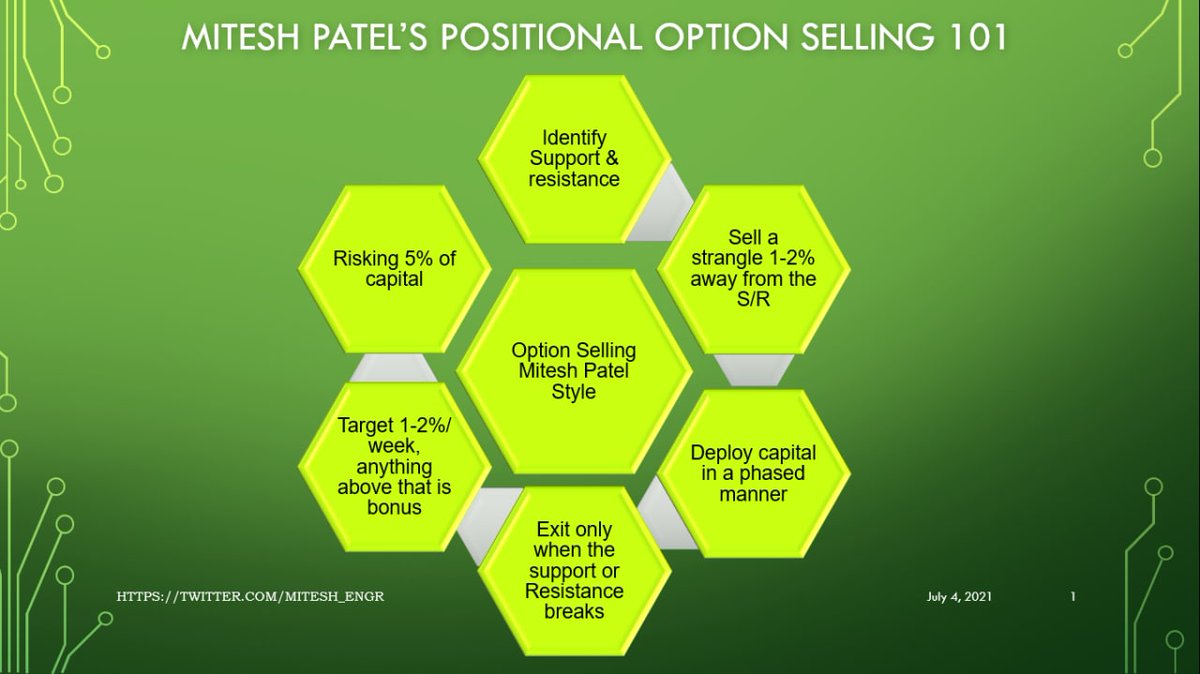

- How to find direction

- Which options to sell

- How to deploy capital

- Exit criteria

- What ROI he targets weekly

- What % risk he takes

How to find direction

- Daily charts S/R

- 75 min charts S/R

- Intraday trend

- Always play directional

- Never trades in strategies

Which options to sell in weekly expiry

- Weekly candle High/Low

- Sell 1% away options from those

- Exit when levels breached

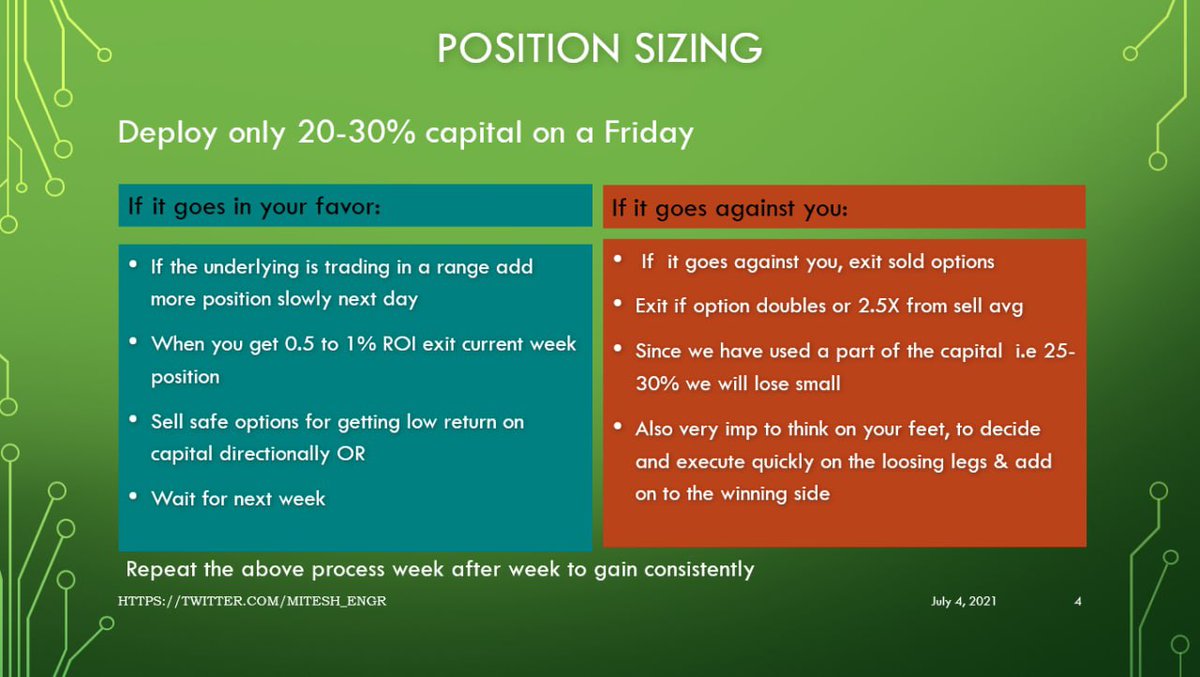

Position Sizing. How to deploy your capital?

- First sell 20%

- Pyramid the next day

- When to exit

- What to do when view goes wrong

- What to do with idle capital

Strategies or No Startegies

- What Data to look at

- ROI for safe players per month

- Max risk per day

- Gather knowledge and play directional

- Never play strategies

What kind of returns should traders expect

- Monthly 2% easily via index options

- With little risk 4-5%

- Beginners weekly target – 0.5%

- Consistency

- Trade fearlessly later

Other Points

- Never average losers

- Remember levels of stocks

- Cut losses immediately

- Overnight positions – Control position sizing/ hedge

How to determine Stop Loss

- Options levels

- Bank Nifty future levels

- At that level check option price and keep that as an SL

- Rely on theta decay to help you

- This will lower your SL further

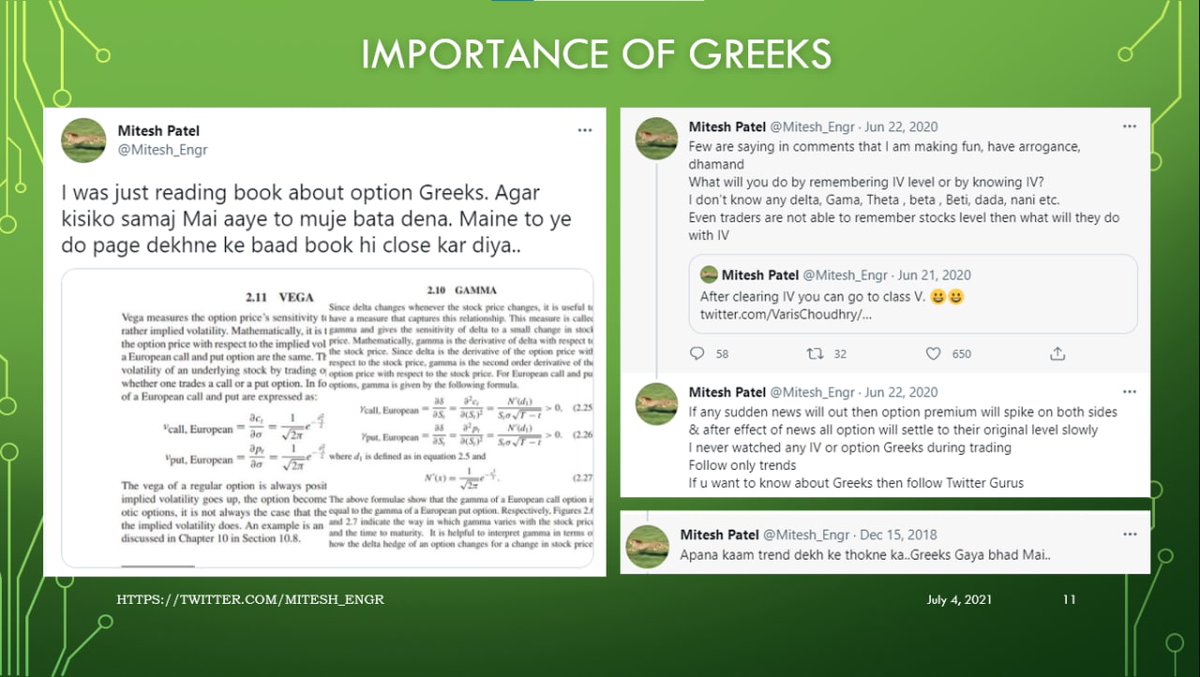

Importance of IV

- Doesn’t serve much purpose

- When news is priced in option premium cools

- Don’t be fooled by twitter gurus

Importance of Greeks

Is Option selling limited profit?

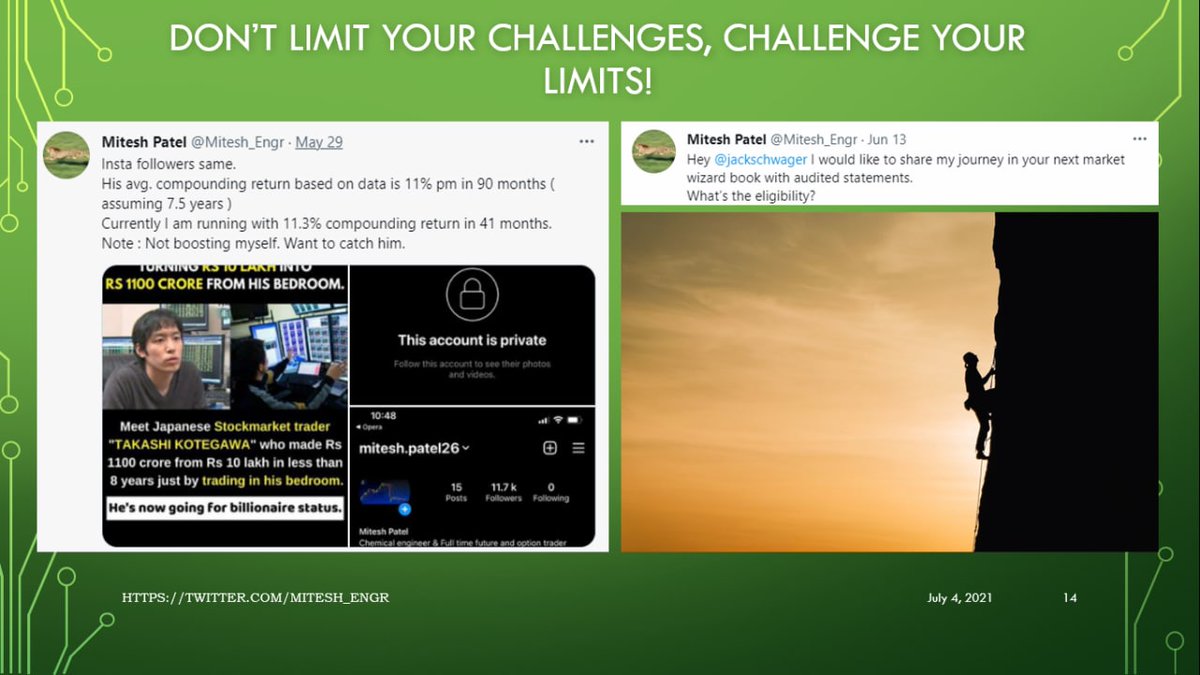

Power of BRUTAL compounding

Mental Block

- Do not have any metal blocks like 1% per week

- Aims high