Calendar Spread Is a IV Explansion Play. Use it when IV is real low

Implied Volatility decreases if the options price decreases, meaning people are selling more options as opposed to buying them.

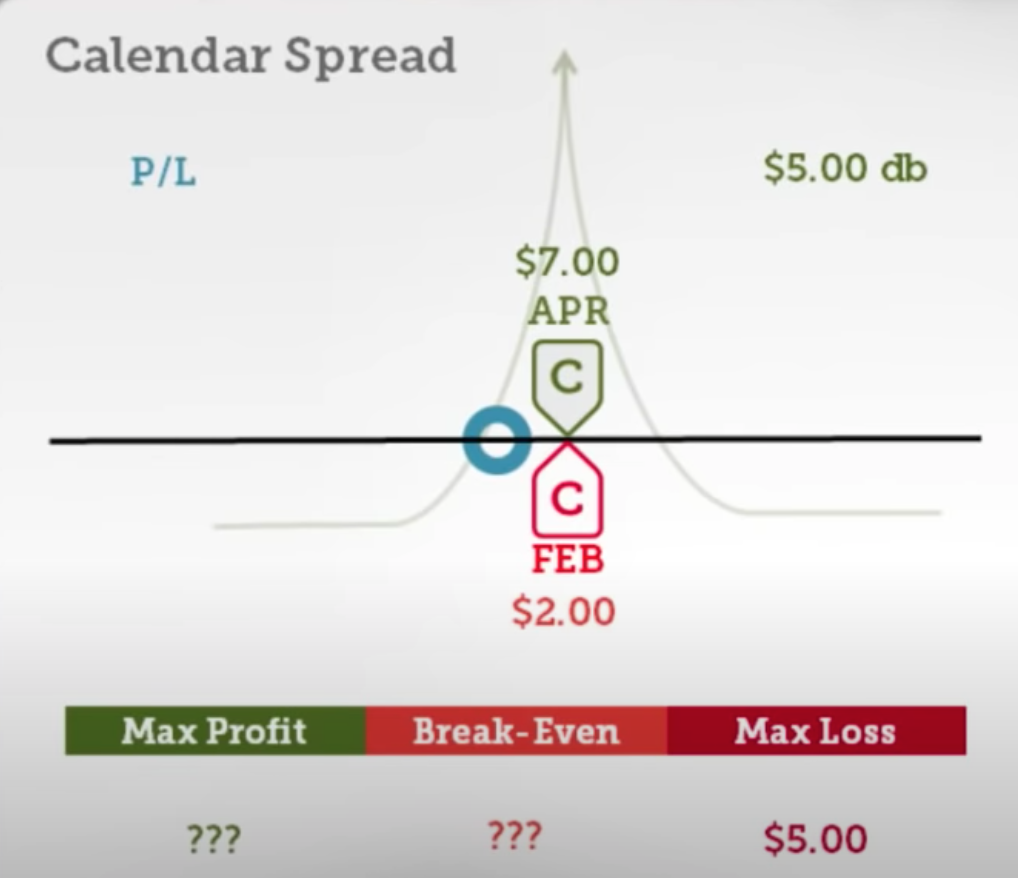

Say Volatility has increased but the stock price has not moved at all, what will happen at expiration

There will be marked loss in the Feb Option above because short option is short delta, gamma and vega

However, at 1-minute prior to expiration, the Feb call will trade fully intrinsic value. But the Feb call is OTM, hence it will vanish leaving us with a $5 net debit and a long April call with a certain value

Analysis

- Use this when IV is less and you expect IV to increase

- Note the IV has mean reverting properties

- To decide whether to take call or put calendar spread OTM.

- Note Put is always skewed and will trade expensive.

- If view is of underlying price dropping and being out of money then go for call spread

- If view is of underlying price drift up and being out of money then go for put spread

- Theta is more on short dated option than on long dated option. Vega , Gamma and delta is more on far expiry option than on short expiry option, thereby we can use the far expiry OTM to offset the vega of the short expiry option.